Canada’s Middle-Power Trap: Can Canada Afford to Choose Between the U.S. and China?

Canada is facing a problem that many medium-sized economy countries eventually hit: the “middle-power trap.” It finds itself in a balancing act between the United States and China. The 2026 Canada-China agreement has made this phenomenon salient. Rather than choosing one of the two superpowers outright, Canada is attempting to engage both, a pragmatic strategy, but one fraught with challenges in trade, technology, security, and diplomacy. This article examines how the trade agreement with China illustrates Canada’s situation and raises questions about whether Canada can afford to take a side or must continue balancing relationships with both Washington and Beijing.

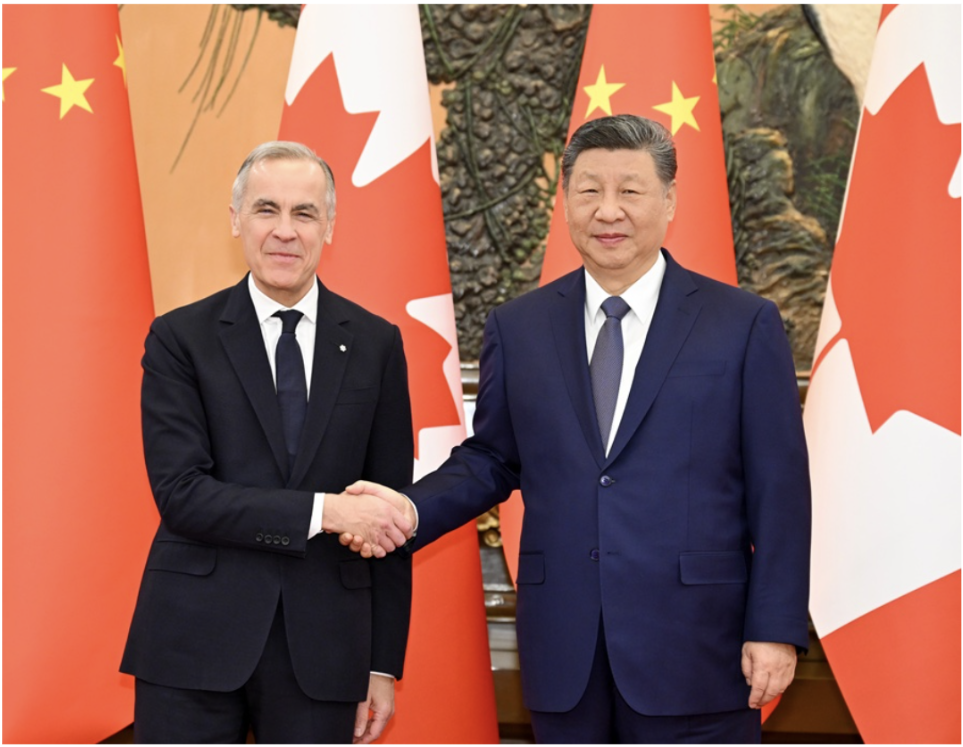

In January 2026, Canadian Prime Minister Mark Carney visited Beijing, becoming the first Canadian Prime Minister to do so in eight years. The trip marked the formation of a new partnership with China. Central to this partnership is a comprehensive agreement aimed at lowering tariffs, trading clean technology, and climate competitiveness.

Clean Energy and Technology Cooperation

Canada and China agreed to collaborate on initiatives focusing on batteries, solar, wind, and energy storage. Chinese companies are being courted to invest in Canadian clean tech and battery production, aligning with Canada's goal to build a low-carbon economy.

In exchange for Chinese concessions, Canada will allow up to 49,000 Chinese electric vehicles (EVs) into its market annually at the normal 6.1% tariff rate (removing a previous 100% surtax). This quota amounts to under 3% of Canada’s auto market and essentially restores Chinese EV imports to their levels before recent trade frictions. The agreement anticipates that within a few years, affordable Chinese EV models (under $35,000) will spur joint ventures in Canada and create jobs in the domestic auto supply chain (Government of Canada).

Agricultural Trade Breakthrough:

In addition, the deal seeks to end the trade war, which had been detrimental to the Canadian agriculture sector. China agreed to reduce tariffs on Canadian canola seed from 85% to 15% by March of this year (Government of Canada). It also removes special duties on Canadian canola meal, peas, and seafood products. Currently China is Canada’s second-largest export market for agricultural goods and lumber, buying about $13.5 billion worth in 2024 (PRS Group).

Security and Law Enforcement Cooperation:

Despite political differences, Canada and China commit to cooperation on public safety issues. Law enforcement and intelligence agencies will work together against narcotics trafficking, cybercrime, money laundering, and synthetic drugs, aiming to make communities safer in both countries. This agreement effectively resets Canada-China relations after years of acrimony.

TRADE AND ECONOMIC DILEMMA

Despite optimistic developments in Chinese–Canadian relations, improvements in bilateral ties may occur at the cost of deteriorating relations with the United States. Currently, the United States is Canada’s largest trading partner, accounting for roughly two-thirds of Canada’s total trade (Reuters). In contrast, China – despite being the second-largest single-country partner, comprises less than 10% of Canadian trade. Thus, Canada cannot alienate the American market, which buys the majority of Canadian exports.

However, Canada’s over-reliance on a single partner comes with risks. Under the Trump Administration, U.S. trade policies have become unpredictable, marked by the sudden twenty-five percent tariff imposed on Canadian steel and aluminum in March. However, drawing closer to China on trade can clash with Canada’s commitments to the U.S. under existing agreements. Notably, the US, Mexico, and Canada Agreement (USMCA), the successor to NAFTA, contains a clause discouraging deals with non-market countries like China. In addition, one of the articles requires Canada to inform the U.S. if it enters trade talks with China, and even allows the U.S. and Mexico to terminate the pact if Canada signs a free trade agreement with Beijing. While the 2026 Canada-China partnership is not a full free trade agreement, it tests that provision.

Canada must therefore perform a careful balancing act. The challenge is to diversify without divorce, to gain the benefits of trade with China while maintaining the strong relationship it has with its closest neighbor.

TECHNOLOGY, SECURITY, AND CONCLUSION

Economic cooperation with China also raises questions in the realms of technology and national security. The 2026 agreement emphasizes clean tech and industrial collaboration, for example, joint work on EV batteries and renewable energy infrastructure. Such partnerships can help Canada’s innovation goals and climate targets.

For example, in 2022, Canada banned China’s Huawei from its 5G telecommunications network due to pressure from the U.S. Canada is also a founding member of NATO and part of the NORAD pact that jointly defends North American airspace with the United States. Ottawa cannot afford to lose this intelligence cooperation or military defence system with the U.S. in pursuit of Chinese deals (Nagy).

Canada's position as a middle-capacity power leaves little room for direct confrontation. The question “Can Canada afford to choose between the U.S. and China?” is answered by reality: choosing one over the other is too expensive.

Sources:

Al Jazeera. “Canada’s Carney Hails ‘Strategic Partnership’ in Talks with China’s Xi.” Al Jazeera, 16 Jan. 2026, www.aljazeera.com/news/2026/1/16/canadas-carney-hails-strategic-partnership-in-talks-with-chinas-xi. Accessed 20 Jan. 2026.

Government of Canada. “Preliminary Agreement-in-Principle to Address Economic and Trade Issues with China.” Global Affairs Canada, 16 Jan. 2026, www.international.gc.ca/news-nouvelles/2026/2026-01-16-china-chine.aspx?lang=eng. Accessed 20 Jan. 2026.

Government of Canada. “Prime Minister Carney Forges New Strategic Partnership with the People’s Republic of China.” Prime Minister of Canada, 16 Jan. 2026, www.pm.gc.ca/en/news/news-releases/2026/01/16/prime-minister-carney-forges-new-strategic-partnership-peoples. Accessed 20 Jan. 2026.

Nagy, Stephen. “Dangerous Delusion: Why Pivoting to China Is a Huge Mistake for Canada.” Macdonald-Laurier Institute, 22 Aug. 2025, macdonaldlaurier.ca/dangerous-delusion-why-pivoting-to-china-is-a-huge-mistake-for-canada-stephen-nagy-in-national-security-journal/. Accessed 20 Jan. 2026.

PRS Group. “Canada’s New Deals with China/Qatar: What Are the Geopolitical Considerations Shaping the ICRG Risk Model?” PRS Group, 18 Jan. 2026, www.prsgroup.com/canadas-new-deals-with-china-qatar-what-are-the-geopolitical-considerations-shaping-the-icrg-risk-model/. Accessed 20 Jan. 2026.

Reuters. “Canada’s Carney Aims to Lead New Global Trading Order Less Reliant on US.” Reuters, 20 Jan. 2026. Accessed 20 Jan. 2026.

Reuters. “Canada’s Trade War Reset Will Be a Gentle One.” Reuters (Breakingviews), 20 Jan. 2026. Accessed 20 Jan. 2026.