The Federal Reserve at a Critical Juncture: Courts, Politics, and the Next Chair

(AP Photo/Julia Demaree Nikhinson, File)

President Trump and Federal Reserve Chair Jerome Powell visited the construction site of the Federal Reserve’s new building on July 25th, 2025, where the president questioned the total cost of the renovations in front of the press.

On January 11th, 2026, Jerome Powell, the chairman of the Federal Reserve of the United States, announced that he had been subpoenaed by the DOJ and was under criminal investigation following his testimony before the Senate Banking Committee in June of 2025 regarding renovations at the institution's buildings. Powell followed this announcement with a statement that marked a break from the FED’s usual stance of avoiding political involvement: “The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President.” There followed a historic indirect dialogue between the FED and the White House, as the president then said in the evening in an interview with NBC News: “I don’t know anything about it, but he’s certainly not very good at the FED, and he’s not very good at building buildings.” It seems difficult to believe that the president was not aware of the investigation coming up, however. Following his inauguration as 47th president of the United States in January 2025, the president has constantly attacked the institution’s independence by threatening to fire Powell, whom he went from calling “strong, committed and smart” when he nominated Powell as chair in November 2017 to “Too Late Powell” and other insults because of his discontentment with monetary policy. One can also remember the historic interaction between the two men at the construction site in July 2025, when Trump took out a document in front of the press and questioned the Federal Reserve’s numbers, claiming the construction cost had gone up from $2.7 billion to $3.1 billion (see picture).

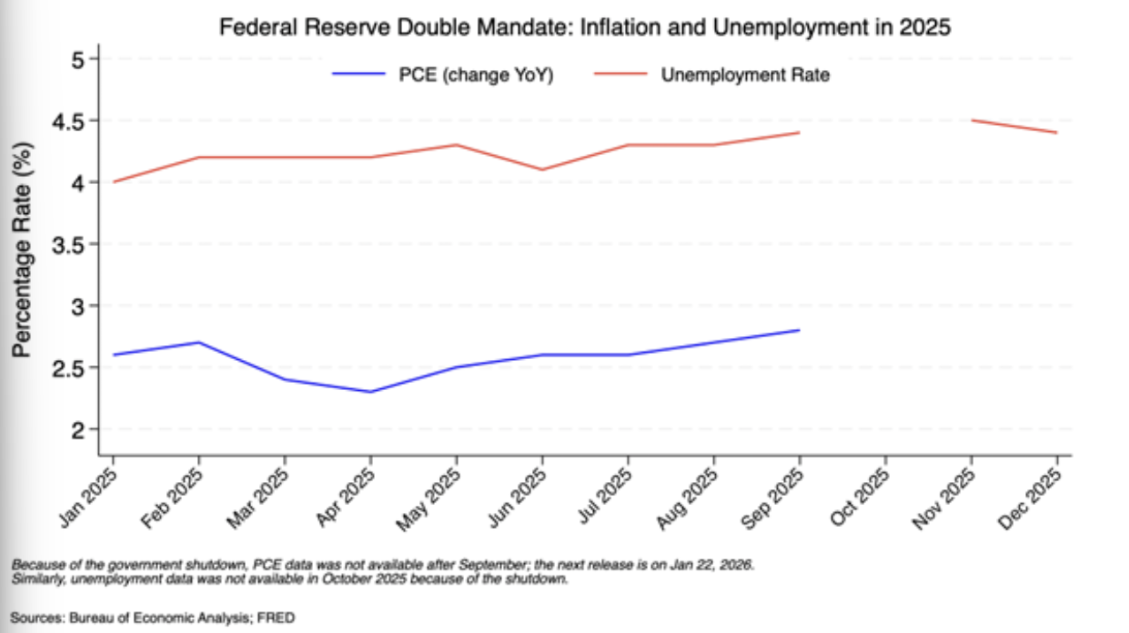

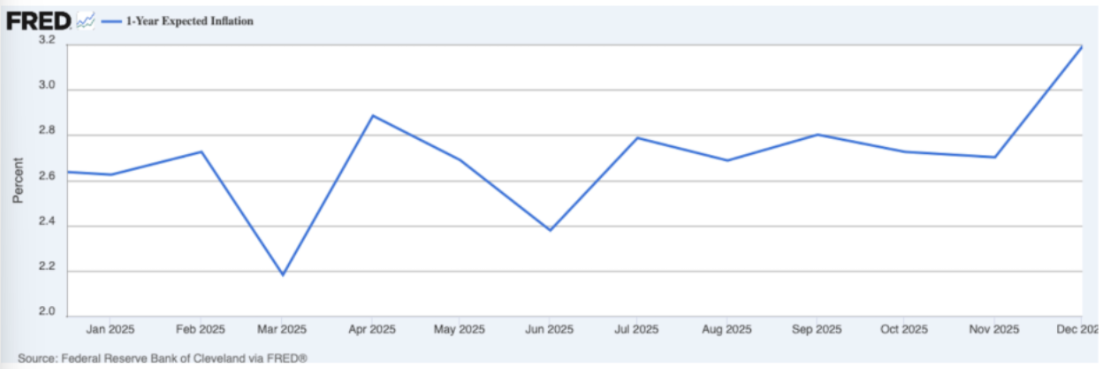

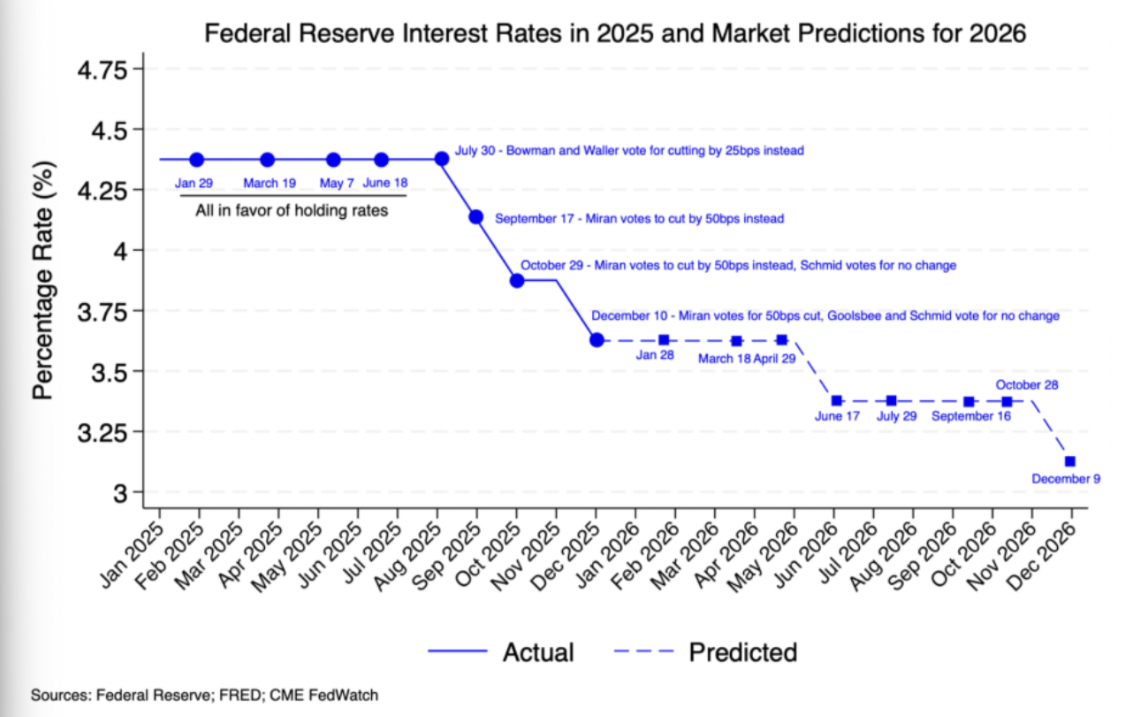

Throughout 2025, the president has repeatedly urged the institution to cut interest rates to stimulate the economy by making short-term borrowing cheaper, which in turn could create more jobs and lower mortgage rates. These are goals that, if achieved, would help the president’s political position and his political party in the midterm elections of November 2026. However, the Federal Reserve is an independent institution which does not focus on short-term political objectives but instead follows a dual mandate of maintaining relative price stability at 2% inflation and promoting full employment. It is the former objective that has prevented the central bank from cutting rates in the first eight months of the year. As seen in Figure 1, PCE, the indicator used by the FED to measure inflation, was already at a higher level than 2%, at 2.6%, in January 2025 when the president took office for the second time. Ironically, Trump’s own policies contributed significantly to elevated inflation rates. In January, the president launched his first trade attacks against Mexico, Canada, and China, three of the US’ largest trading partners, which pushed inflation expectations up in the month of February (Figure 2). Again on Liberation Day in April, Trump launched a trade war on the world by imposing levies on dozens of countries. This spooked markets – the S&P 500 lost 12% of its value in the days following the announcement (Yahoo Finance), a drop similar to periods of crisis like the 2008 recession or the Covid pandemic – and again pushed inflation fears up. Only in the last three of the eight meetings of the year, in September, October, and December, did the Federal Reserve cut interest rates by one quarter percentage point in each of the meetings, thus prioritizing its employment mandate when unemployment seemed on the rise since inflation remained well above 2% (see Figure 3).

Figure 1

From Bureau of Economic Analysis; FRED

Figure 2 1-year Inflation expectations in 2025, monthly

From FRED

Figure 3

From Federal Reserve, FRED, CME FedWatch

In fact, threatening the central bank’s independence might have the opposite effects of the ones desired by the administration like driving foreign capital away or increasing the interest on the country’s debt. The institution's independence is one of the pillars of the US economy since, as Powell has repeatedly explained, it aims to achieve its dual mandate regardless of the administration in place, and plays a key role in maintaining the dollar as the reserve currency, for the trust that foreign investors place in the institution. Policymakers and investors alike would undoubtedly agree that 2025 was marked by uncertainty brought about by the Trump’s administration’s trade war, among other factors. This pushed gold prices to record highs, as they rose by 68% in 2025 according to Bullion Vault. It also led to a fall of 8% in the DXY, an index weighing the dollar against a basket of major currencies, as investors diversified away from the US economy or hedged their dollar transactions (J.P. Morgan). This tendency to hedge was amplified by threats to the Federal Reserve not only as a pillar of the American economy but also the world economy and the risk that it would suddenly find itself at the mercy of the political desires of the White House.

This judicial attack on the Federal Reserve reminds investors of the first perceived attack at the institution's independence when Trump wished to fire Powell’s fellow central bank governor Lisa Cook in August 2025 over mortgage fraud. Cook has constantly voted like Powell since her appointment in March 2022, so by firing her Trump would undoubtedly like to replace her with a governor who is less worried about holding inflation at 2%. A judge from a lower court of the District of Columbia blocked her firing, allowing Cook to remain on the board of governors - where she still holds on to her seat as these lines are written on January 19th, 2026. When the president claimed that he had the right to fire Cook before the Supreme Court, it was decided that oral arguments would be heard by the nine justices on the 21st of January 2026. Trump is only allowed to fire Cook for ‘cause’ from the Federal Act of 1913, with the ‘cause’ not specifically specified by the law.

There are fears that the Supreme Court will rule in Trump’s favor for two important reasons. First is the proximity between the White House and the Supreme Court, since the Court leans more to the right with six conservative justices and three liberals, with three of the former conservatives having been appointed by the president while he was in office for the first time. More importantly, in 2025 the Court went against precedent by allowing the president to fire directors of independent institutions. Indeed, in May 2025 the Court allowed Trump to fire Gwynne Wilcox and Cathy Harris from the National Labor Relations Board and the Merits Systems Protection Board, respectively. Similarly, when Trump fired Rebecca Slaughter, the commissioner of the Federal Trade Commission (FTC) in March 2025, the Court approved of that decision in September.

However, even considering the Court’s higher likelihood to rule in favor of the president, it does view the central bank as holding a special status for which political independence is essential. In May 2025 it wrote in an unsigned opinion: “The Federal Reserve is a uniquely structured, quasi-private entity that follows in the distinct historical tradition of the First and Second Banks of the United States” (SCOTUSblog). It would be the first time a president fires a governor from the Federal Reserve, which is why a broad group of prominent former FED chairs, Treasury secretaries, and senior White House economic advisers spanning both Democratic and Republican administrations submitted a brief urging the justices to allow Cook to remain on the Federal Reserve’s governing board. The court is expected to announce its ruling in late June or July of this year.

One of the seats on the current board of seven governors marked another threat at the institution’s independence in 2025 but also represents the critical juncture awaiting the Federal Reserve of the United States: the economist Stephen Miran. When Adriana Kugler announced her retirement in August 2025 before the expiration of her term on January 31st, 2026, Donald Trump appointed Mr. Miran, allowing him to take a leave of absence from his job as chair of the Council of Economic Advisers at the White House rather than resigning, due to the shortness of the term he would serve at the central bank. This appointment also generated turmoil since Miran was known for his closeness, loyalty, and support of the president in wanting to lower interest rates (Bloomberg). This theory has proven itself since in the three meetings he’s participated, starting in September, and up to December 2025, where the FED cut rates by 25 basis points each, Miran has dissented each time by voting to cut rates by 50 basis points instead (Figure 3).

It’s in determining who will be the next FED chair that Miran’s seat also plays a key role. Jay Powell’s term as chair expires on May 15th of 2026, which will allow the president to nominate a new chair, who must also be confirmed by the Senate. It is customary for the chair of the U.S. central bank to resign their role as governor after the end of their position as chair, even if their mandate as governor hasn’t expired yet. This is the case for Powell, who is thus allowed to stay on the board until January 2028. The last governor to stay on for such a long period in the position of governor after losing the chairship of the institution is Marriner Eccles in 1948 (Deutsche Bank). The reason why Powell could stay on for longer is for fears over the central bank’s independence if Trump is able to appoint a governor in his place who would be supportive of its rate-cutting policies rather than on the double mandate of the central bank.

Therefore, the president has the choice of choosing from the existing governors or an external person who would then replace Miran as his term ends – since it is believed the administration is assuming that Powell would remain on the board of governors (Bloomberg). Were Lisa Cook to be fired, it would also provide the president with an opportunity to position the next FED chair on the Board in her place, but this remains highly unlikely, as the Supreme Court’s ruling is expected at the end of June, after Powell’s chairmanship ends in May.

But who are the candidates for the position of chair and how are they likely to shape the future of the institution and shed light on the threats to its independence? This is also knowing that at the beginning of 2026 President Trump announced that he has made his choice already, so a decision could come out at any moment. Secretary of the Treasury Scott Bessent – himself a likely candidate even though he suggests that he is not considering the role – is the one that has conducted the interviews for a long time, which ended in late November 2025. The first candidate, and the only one currently sitting on the board of governors of the central bank next to Jay Powell and Lisa Cook, is Christopher Waller. He was appointed by Donald Trump during his first term and was confirmed by the Senate in December 2020. Being on the board is an advantage for his candidacy since he has the experience of working with the other governors, but most importantly because he is known by the market community as favorable toward cutting rates - which is why the president considers him – but not in an extreme way as the other candidates that are less hawkish about inflation (BBC). Indeed, in the central bank’s decisions for 2025, he remained in line with the other governors except on July 30th, when he voted to cut rates by 25bps instead of holding, as seen on Figure 3.

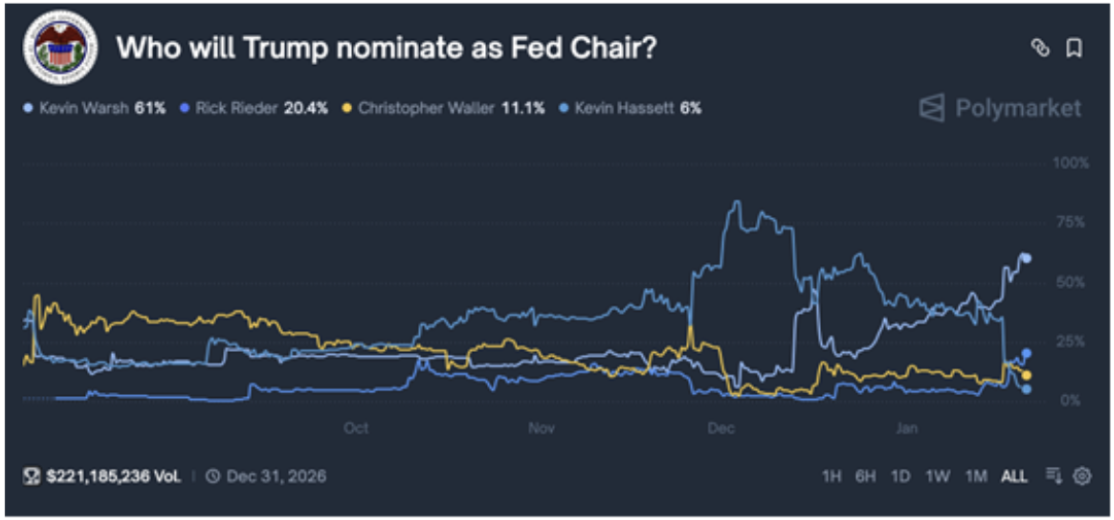

Two of the favorites for the role are Kevin Hassett and Kevin Warsh. The former is a close ally of Donald Trump who previously chaired the White House Council of Economic Advisers during his first administration and currently heads the National Economic Council. He has consistently defended Trump’s economic agenda, frequently minimizing evidence pointing to a slowdown in the U.S. economy and echoing claims that official labor statistics are politically biased (BBC), which means he would surely push toward rate-cutting at all costs thus sparking fears about the institution’s independence. On Polymarket (Figure 4) he was long seen to be the favorite candidate until his odds collapsed when Trump said, "I actually want to keep you where you are".

Kevin Warsh, who is now leading the polls on Polymarket, was a member of the Federal Reserve’s Board of Governors between 2006 and 2011. He has positioned himself as a vocal critic of the FED, attacking both its data-driven policy framework and its extensive use of unconventional balance-sheet tools (BBC). His tone has hardened since becoming a serious contender for the chairmanship this year; he has gone so far as to argue that the institution requires a fundamental “regime change.” He also believes in cutting interest rates. Furthermore, according to the BBC, he maintains strong personal ties to Trump’s inner circle, notably through his father-in-law, billionaire Ronald Lauder, a long-standing Trump supporter and major donor, which undoubtedly helps his chances.

Finally, Rick Rieder, who is the current CIO of Global Fixed Income at BlackRock, has seen his candidacy “gain traction” (Bloomberg). He has met with the president, and he has said that independence of the institution is crucial and has agreed with the Treasury Secretary’s will to simplify the institution (Bloomberg). It is thus very difficult to predict who will be the next chair, knowing Donald Trump could also choose someone who doesn’t appear in the list of candidates, such as the Secretary of the Treasury himself.

Figure 4

Odds on the PolyMarket betting Platform on the nomination of the next FED chair by Trump to the Senate

From PolyMarket, January 19th, 2026

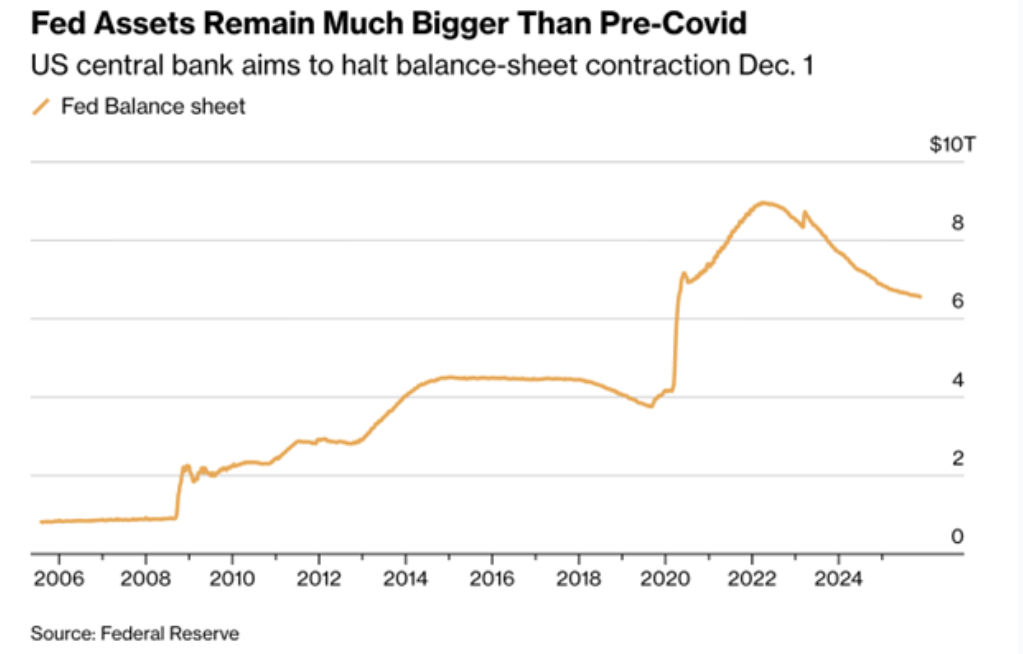

One of the recurring themes in the Secretary of the Treasury’s interviews has been changes within the institution. According to Bloomberg, he indicated that he wished for the simplification of the US central bank, which he said has become too complex in how it manages the money markets, including the repo transactions that involve holding or buying treasury securities to inject liquidity in the system in times of crisis like the 2008 recession or the Covid pandemic – even though since 2022 it has been reducing its balance sheet (Figure 5). However, he remained vague about it.

Figure 5 - Federal Reserve Balance Sheet

From Bloomberg, Federal Reserve

Many developments are thus expected to come out in the next few weeks concerning the Federal Reserve’s future, from judicial affairs that have been seen as an attack on its independence, to the new leader of the institution and the structural changes it would undergo in the next few years. At risk is the dual mandate of the central bank which plays such an important role in the US and world economies. So at a time when central banks around the world see their independence coming under threat, as is also the case in Turkey where Recep Erdogan has throughout the years forced the institution to cut rates only to see inflation spark and lead to a crisis, or in Brazil where in June 2024 Lula characterized the central bank chief as an “adversary” following a rate hold (Bloomberg), what example will the Federal Reserve give to the rest of the world?

References:

Federal Reserve Chair Powell says DOJ has subpoenaed central bank, threatens criminal indictment, The Washington Post, January 11, 2026 https://www.washingtonpost.com/business/2026/01/11/federal-reserve-trump-subpoena/e61fcc0e-ef51-11f0-a4dc-effc74cb25af_story.html

Trump’s disastrous undermining of the Federal Reserve, Le Monde, January 14th, 2026 https://www.lemonde.fr/idees/article/2026/01/14/le-desastreux-travail-de-sape-de-trump-sur-la-fed_6662144_3232.html

De-dollarization: Is the US dollar losing its dominance?, J.P. Morgan, July 1, 2025 https://www.jpmorgan.com/insights/global-research/currencies/de-dollarization

Trump v. Cook: an explainer, SCOTUSblog, January 16th, 2026 https://www.scotusblog.com/2026/01/trump-v-cook-an-explainer/

Who are the frontrunners for the top Fed job?, BBC, January 16th, 2026 https://www.bbc.com/news/articles/c4g907zekllo

Trump names Miran to fill seat on Federal Reserve Board, Bloomberg, August 8, 2025 https://www.bloomberg.com/news/articles/2025-08-07/trump-names-miran-to-fill-seat-on-federal-reserve-board

BlackRock’s Rick Reider bid for chair is gaining traction, Bloomberg, January 18, 2026 https://www.bloomberg.com/news/articles/2026-01-17/blackrock-s-rick-rieder-bid-for-fed-chair-is-gaining-traction

Powell could stay on as Fed governor after giving up chair role, like former chief Eccles, Seeking Alpha December 2, 2025 https://seekingalpha.com/news/4527798-powell-could-stay-on-as-fed-governor-after-giving-up-chair-role-like-former-chief-eccles

Speculating on the next Fed Chair, Seeking Alpha, December 2, 2025 https://seekingalpha.com/article/4849309-speculating-on-the-next-fed-chair?messageid=confirm_registration

Bessent calls for simplified Fed as he ends candidates interviews, Bloomberg, November 25th, 2025 https://www.bloomberg.com/news/articles/2025-11-25/bessent-calls-for-simplified-fed-as-he-ends-candidate-interviews

Federal Reserve Board: Current and Historical Membership, Congress.gov https://www.congress.gov/crs-product/R48233#_Ref165031017

Meeting calendars, statements, and minutes (2021-2027), Federal Open Committee https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm